|

dog health insurance rates: a practical comparison guideWhat shapes the costRates aren't guesswork; they follow risk. Insurers look at your dog's age, breed, where you live, and how rich the coverage is. A few sliders change the bill more than others. - Breed and size: Higher orthopedic or respiratory risk breeds tend to cost more. Giant breeds often sit in higher tiers.

- Age: Premiums usually climb as dogs get older, and new policies may limit starting ages.

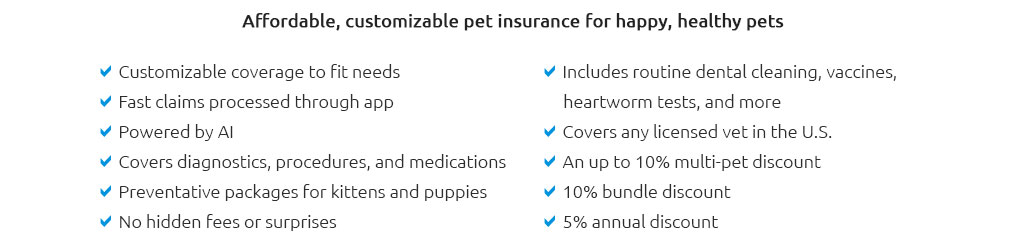

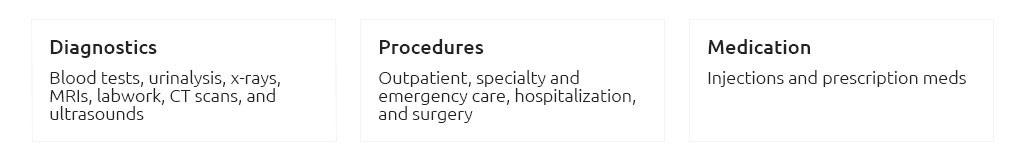

- Coverage depth: Accident-only is cheapest. Accident and illness costs more. Add-ons (dental illness, rehab, behavioral) push rates higher.

- Deductible and reimbursement: Higher deductibles lower rates. So do lower reimbursement percentages.

- Annual limit: A $5,000 cap may be markedly cheaper than $20,000 or unlimited.

- ZIP code: Veterinary costs vary by region; rates follow.

- Claims history and inflation: Veterinary price trends and your prior claims can nudge renewals upward.

Typical monthly ranges you might seeThese are illustrative, built from real quotes and market norms. Your numbers can land lower or higher, but the pattern holds. - Small mixed-breed puppy, accident-only: roughly $15 - $30.

- Small mixed-breed puppy, accident + illness: roughly $30 - $60.

- Large purebred adult (moderate risk), accident + illness: roughly $45 - $90.

- Senior dog, comprehensive with higher limits: roughly $70 - $130+.

How plan math affects your walletImagine a $3,000 surgery, $250 annual deductible, and 80% reimbursement with a generous annual limit. You'd first pay the deductible ($250). The insurer applies 80% to the remaining $2,750, paying $2,200. Your coinsurance is $550. Total out-of-pocket: $800. If you had chosen 70% reimbursement, your premium would likely be lower, but your share on that claim would rise. Comparing plans step by step- Align the variables: Set the same deductible, reimbursement, and annual limit across quotes so you can compare apples to apples.

- Read exclusions: Look for hereditary, congenital, dental illness, and bilateral condition language.

- Check benefit details: Are exam fees covered? Are Rx meds included? Any rehab or behavioral therapy limits?

- Model one expensive year: Price out a cruciate repair or foreign-body surgery using each plan's math.

- Scan waiting periods: Orthopedic waiting periods vary widely; some allow waivers with a vet exam.

- Note claim process: Direct pay versus reimbursement after you pay can matter during emergencies.

A quick real-world checkLast fall, I compared rates for Luna, an anxious 4-year-old rescue, ahead of a planned dental with possible extractions. Toggling her deductible from $200 to $500 trimmed the premium by about 12% while only raising projected out-of-pocket by $300 in a worst-case dental year. Her owner chose the higher deductible, then set aside the difference in a savings buffer - calm, practical, and it worked. Rate changes after the first yearRenewals may rise due to your dog's aging, local vet cost trends, and overall claims experience. It's normal to see periodic increases; large jumps can happen after heavy-claim years, but they're not guaranteed. - Mitigate with structure: Increase the deductible or trim the annual limit a notch if the premium outruns your budget.

- Re-shop at renewal: If you switch, watch for new waiting periods and pre-existing condition rules.

- Ask about discounts: Multi-pet, pay-in-full, military, or employee benefits can help.

- Keep records clean: Detailed invoices help reimbursements flow smoothly, reducing friction and surprises.

Which coverage style fits- Accident-only: Lowest rate, covers injuries, not illness. Suits very tight budgets or dogs with limited illness risk tolerance.

- Accident + illness (baseline): Balanced and popular. Good for most families seeking meaningful protection against common conditions.

- Accident + illness with targeted add-ons: Add dental illness or rehab if your breed and lifestyle point that way. Useful, but each add-on nudges rates upward.

Practical levers to test while quoting- Raise the deductible one step and drop reimbursement from 90% to 80%; check how much the premium moves versus your projected out-of-pocket on a single $2,000 - $4,000 claim.

- Compare a $5,000 limit to $10,000; many claims sit under $5,000, but not all.

- Skip wellness add-ons if your routine care is predictable and you prefer flexibility.

The bottom lineWell-chosen coverage turns scary bills into manageable math. Rates vary, and they do change, yet thoughtful plan design - aligned to your dog's risks and your cash flow - keeps protection usable. With a clear eye on deductibles, reimbursement, and limits, you can secure solid value without overreaching. Quiet confidence beats guesswork here, and it's earned by comparing the numbers calmly.

|

|